앞으로의 성장 동력

| 단기 | 중기 | |

| 전기차 기업 (자동차의 전기화) |

- 사이버트럭 Ramp-up, 수익성 확보 |

- 모델2 - 휴머노이드 |

| AI 기업 (자동차의 지능화) |

- FSD 확대, FSD 라이선싱 |

- 로보택시 |

< 테슬라 2020~2023 연간 IR내 Summary >

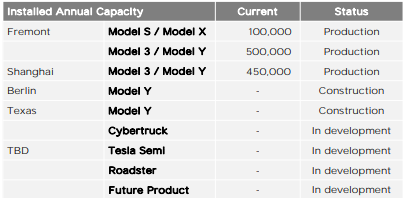

| 2024.1 | In 2023, we delivered over 1.2 million Model Ys, making it the best-selling vehicle, of any kind, globally. For a long time, many doubted the viability of EVs. Today, the best-selling vehicle on the planet is an EV. Free cash flow remained strong in 2023 at $4.4B, even as we focused on future growth projects with our highest capital expenditures and R&D expenses in company history. Energy storage deployments reached 14.7 GWh in 2023, more than double compared to the previous year, while Energy Generation and Storage business profits nearly quadrupled in 2023. Gross profit of our Services & Other business increased from a ~$500M loss in 2019 to a ~$500M profit in 2023. Cost of goods sold per vehicle declined sequentially in Q4. Our team remains focused on growing our output, investing in our future growth and finding additional cost efficiencies in 2024. In late December, we started rolling out V12 of FSD Beta6. Trained on data from a fleet of over a million vehicles, this system uses AI to influence vehicle controls (steering wheel, pedals, indicators, etc.) instead of hard-coding every driving behavior. V12 marks a new era in the path to full autonomy. We are focused on bringing the next generation platform to market as quickly as we can, with the plan to start production at Gigafactory Texas. This platform will revolutionize how vehicles are manufactured. |

- 모델2 출시 예정(텍사스, '25.2H) |

| 2023.1 | Q4-2022 was another record-breaking quarter and 2022 was another recordbreaking year. In the last quarter, we achieved the highest-ever quarterly revenue, operating income and net income in our history. In 2022, total revenue grew 51% YoY to $81.5B and net income (GAAP) more than doubled YoY to $12.6B. As we progress into 2023, we know that there are questions about the nearterm impact of an uncertain macroeconomic environment, and in particular, with rising interest rates. The Tesla team is used to challenges, given the culture required to get the company to where it is today. In the near term we are accelerating our cost reduction roadmap and driving towards higher production rates, while staying focused on executing against the next phase of our roadmap. Our ASPs have generally been on a downward trajectory for many years. Improving affordability is necessary to become a multi-million vehicle producer. While ASPs halved between 2017 and 2022, our operating margin consistently improved from approximately negative 14% to positive 17% in the same period. This margin expansion was achieved through introduction of lower cost models, buildout of localized, more-efficient factories, vehicle cost reduction and operating leverage. In any scenario, we are prepared for short-term uncertainty, while being focused on the long-term potential of autonomy, electrification and energy solutions. Our relentless cost control and cost innovation is why we believe that no other OEM is better equipped to navigate through 2023, and ultimately succeed in the long run, than we are. |

- 판가 지속 인하, 원가절감으로 극복 |

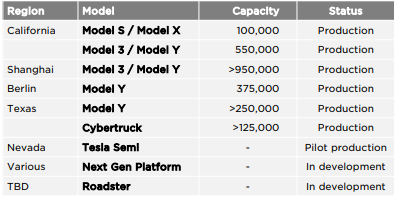

| 2022.1 | 2021 was a breakthrough year for Tesla. There should no longer be doubt about the viability and profitability of electric vehicles. With our deliveries up 87% in 2021, we achieved the highest quarterly operating margin among all volume OEMs, based on the latest available data, demonstrating that EVs can be more profitable than combustion engine vehicles. Additionally, we generated $5.5B of GAAP net income and $5.0B of free cash flow in 2021 – after spending $6.5B to build out new factories and on other capital expenditures. After a successful 2021, our focus shifts to the future. We aim to increase our production as quickly as we can, not only through ramping production at new factories in Austin and Berlin, but also by maximizing output from our established factories in Fremont and Shanghai. We believe competitiveness in the EV market will be determined by the ability to add capacity across the supply chain and ramp production. Full Self-Driving (FSD) software remains one of our primary areas of focus. Over time, our software-related profit should accelerate our overall profitability. More importantly, FSD is a key component to improve automobile safety as well as further accelerating the world’s transition to sustainable energy through higher utilization of our vehicles. While 2021 was a defining year for our company, we believe we are just at the very early stages of our journey. Thank you for being part of it. |

|

| 2021.1 | This past year was transformative for Tesla. Despite unforeseen global challenges, we outpaced many trends seen elsewhere in the industry as we significantly increased volumes, profitability and cash generation. For the full year 2020, we achieved an industry-leading 6.3% operating margin (despite an increase of SBC to $1.7B). Teams across our organization, including supply chain, manufacturing, logistics and delivery, rose to the occasion to ensure strong execution. In addition, we continued to improve our products and make progress on our long-term roadmap. We ramped Model 3 in China to over 5,000 cars per week and started production of Model Y at Gigafactory Shanghai less than a year after breaking ground on the expansion. We also launched and ramped Model Y in Fremont in 2020. In Berlin and Austin, we remain on track to start vehicle production this year with structural batteries leveraging in-house battery cells. Our engineering team has made significant progress on Full Self Driving (FSD) software, with a limited release to customers. Finally, we are excited to ramp the updated Model S and Model X and deliver our first Tesla Semi by the end of the year. While 2020 was a critical year for Tesla, we believe that 2021 will be even more important. Thank you for your trust and support and for being on this journey with us. |

- 베를린/텍사스 공장 연내 가동 → 베를린 : '22.3 가동 텍사스 : '22.4 가동 - Semi 연내 출시 → '22.12월 출시(펩시)  |

'소소하게 알아가는 즐거움 > 테슬라 주식' 카테고리의 다른 글

| 엔드 투 엔드 FSD (0) | 2024.01.28 |

|---|---|

| '23.3.1 테슬라 인베스터 데이 (0) | 2023.01.04 |

| 테슬라 vs 주요 빅테크 성장률 (0) | 2022.12.27 |

| 테슬라 신용등급 History (7) | 2022.10.08 |

| 로보택시, 오토비더 (1) | 2022.10.01 |